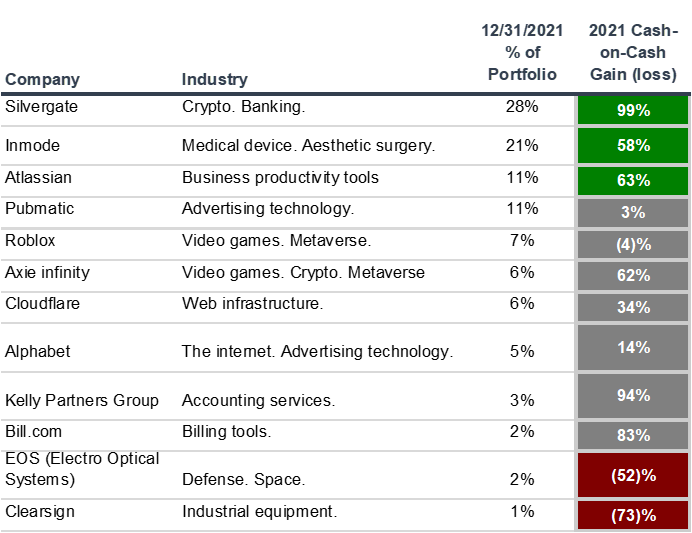

Here is an overview of my personal stock portfolio as of September 30th, 2020.

The 15 companies I own span a wide variety of industries.

- US centric with global revenues: Most of my portfolio companies are headquartered in the US. The rest are all based in Western countries. However, much of the collective revenue is global.

- Predominantly B2B: With the exception of Match Group, the entirety of my portfolio is B2B. A few others–InMode, Slate Grocery REIT– sell to businesses, but are closely driven by consumer spending.

- Mission critical: Many of these companies are mission-critical businesses (Equinix, Kinder Morgan). Their customers would be in serious trouble if they disappeared.

- Diverse value drivers: Some are riding unique, long-term trends (Silvergate, EOS). Some are cyclical (Schlumberger, Total).

- Diverse stages: Some are in high growth mode and reinvesting capital back into the business (Bill.com, Ayden). Some are stable and spitting out double-digit dividend yields (Total, Slate Grocery REIT) or repurchasing large amounts of stock.

- Software Focus: Much of this portfolio is software. Some sell across industries (Atlassian). Others are focused on specific industry verticals (Constellation, Enghouse, Duck Creek).

- Understandable: Most of the tech companies in my portfolio depend less on any cutting-edge technology and more so on their integrations, ecosystems, customer lock-in & network effects.

I’ve bucketed my portfolio into 4 categories to reflect my thinking (More to come in a future article).

Why I’m publicizing my portfolio

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment.

I used to be a professional hedge fund investor. I’ve been investing out of my personal portfolio for some time. I’ve done alright over the past few years, and I find the experience fun.

The reason I’m publicizing my portfolio is because I want you to be my thought partner.

I want you to challenge my beliefs and try to poke holes in my thesis. Please tell me what I’m missing.

I want you to tell me about public companies that I may not know about. And I want you to teach me more about the companies that I already know.

I think investing in public companies helps me become a better entrepreneur & vice versa.

In the coming months, expect to see a series of articles analyzing these companies and discussing my investment philosophy.

Welcome to the combination of value-investing + entrepreneurship.

Drop me a line if you have any questions / comments or just want to get in touch! yz@yishizuo.com