(Note, Part 2 has been published: “Warren Buffett, Charlie Munger, and the Principles of Entrepreneurship“)

I enjoyed my last job as a hedge fund investor. I found the work highly intellectually stimulating.

Being an investor aligned well with my lifelong desire to better understand how our world works

But I felt like something was missing.

Ultimately, I switched career paths and became an entrepreneur for 3 key reasons:

Reason #1 – I want to better understand business operations and the nuances of management in order to become a superior investor in the long-run.

Reason #2 – I am at the right stage of my life to take a risk. I have no kids, and my parents are doing OK financially and health-wise. From a personal perspective, I can afford a career reset if all goes south.

That is my personal Margin of Safety. Nevertheless, I wouldn’t have made the career switch if I didn’t think that the decision would be positive Net Present Value (NPV) — which brings me to the last and most important reason.

Reason #3 – I believe that the long-term, risk-adjusted NPV of being an entrepreneur is higher than any other course of action I could have taken. This is somewhat of a contrarian view, so I will use this post to explain in detail.

I’m going where the market inefficiencies are.

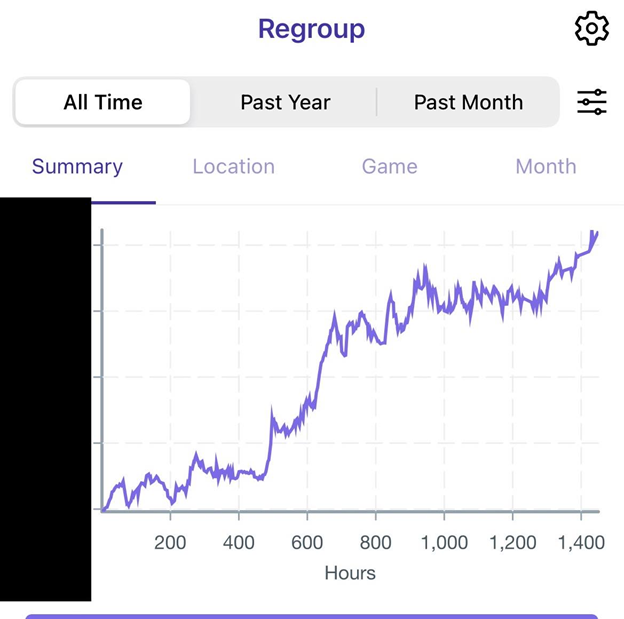

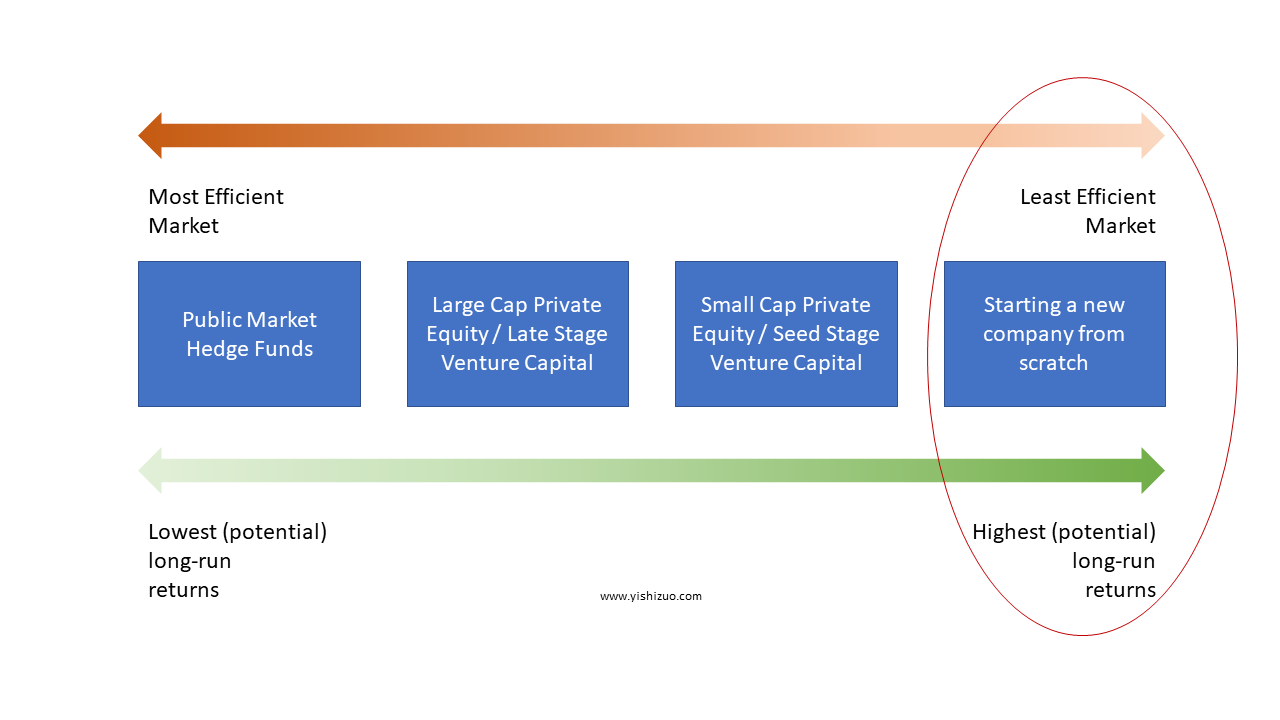

As a former investor, I know that markets are inefficient for good reason. There are more unknowns, less liquidity, and more risks. But I firmly believe that if one is willing to do more legwork to address those risks, then the best returns can be found in the most inefficient markets.

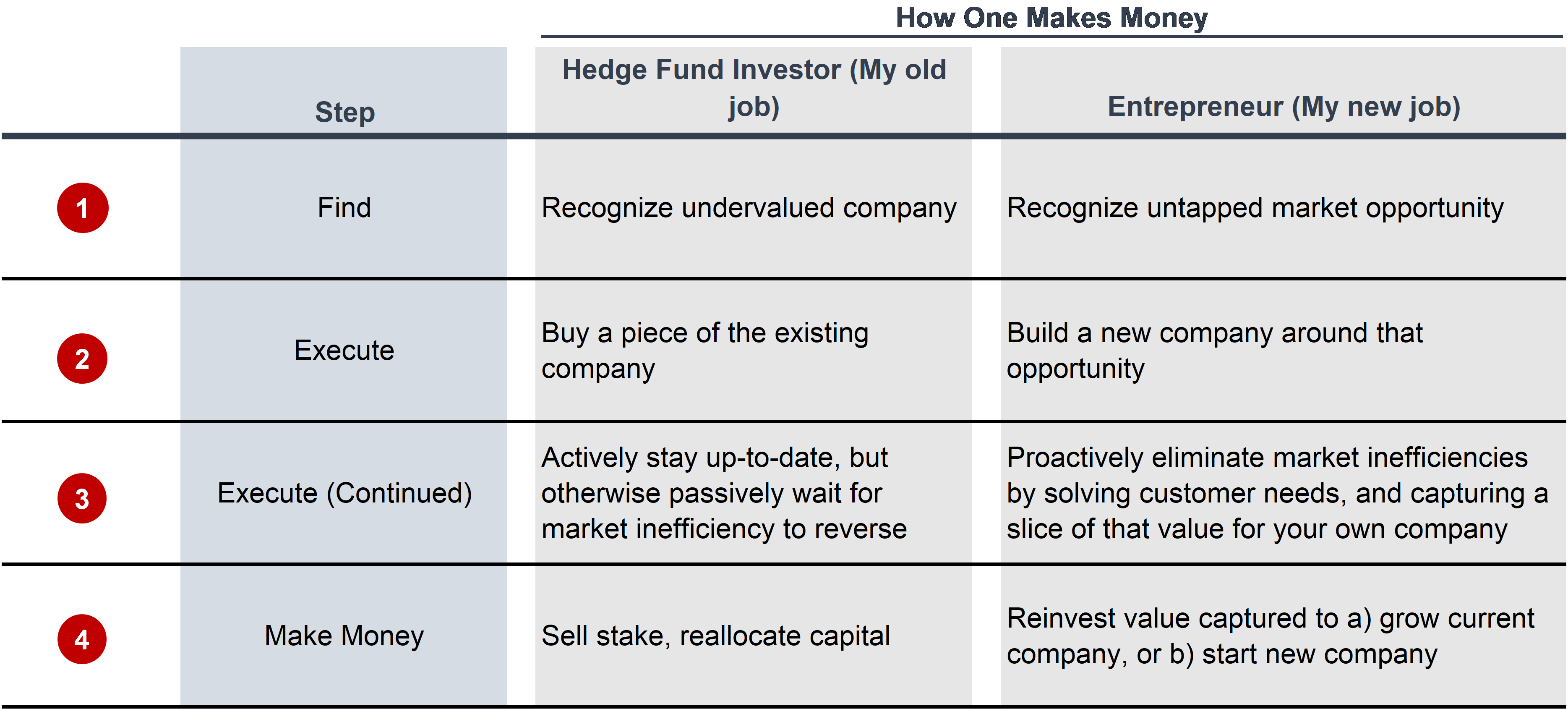

The above diagram illustrates my assertion that the best opportunities of all are found markets in which no company exists yet. And the table below illustrates how I think about the similarities and differences between being an investor vs. entrepreneur.

Clearly, the critical process of execution is very different for an investor vs. an entrepreneur, as are the skills required to succeed. However, I assert that the high-level conceptual framework is the same.

After all, both entrepreneurs and investors look for market opportunities and capture them – the method of execution just varies, depending on how involved you want to be. Either you sit and wait (buy-and-hold hedge fund investor), or you actively build new products to serve customer needs and find more of those customers (entrepreneur). And there is everything in between (activist hedge funds, turnaround private equity shops, hands-on VCs).

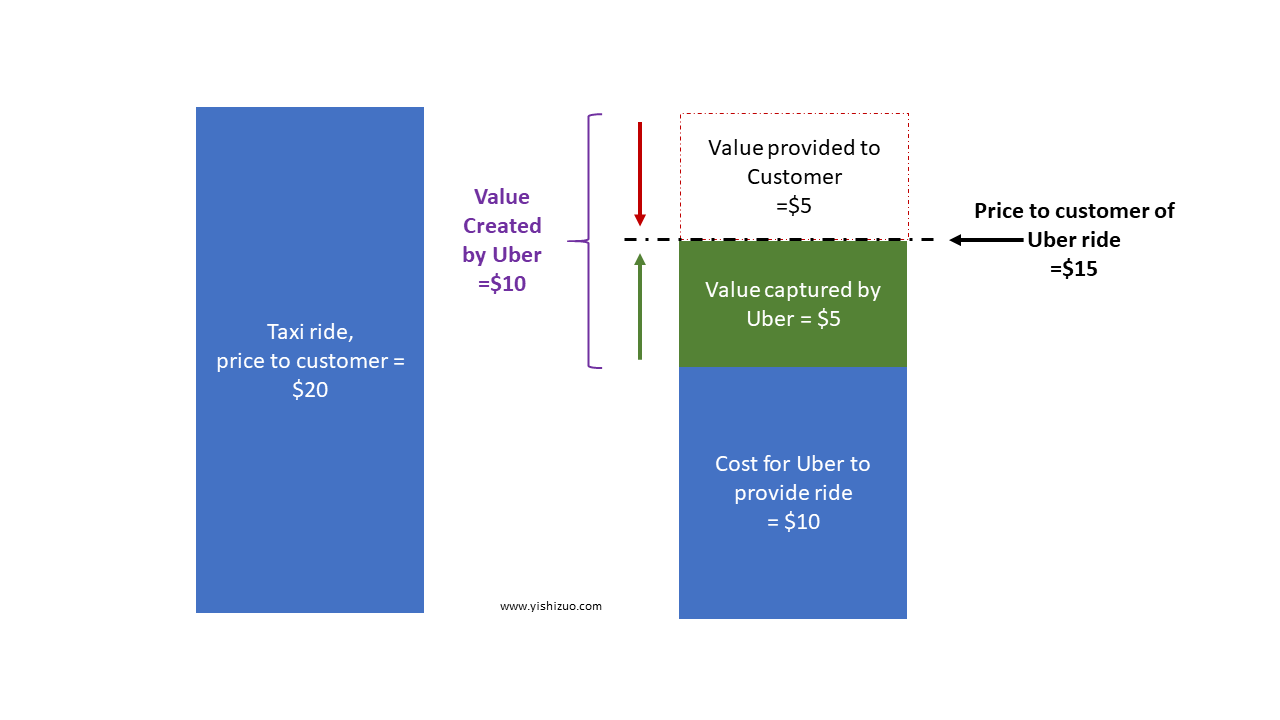

Ultimately, just as hedge fund managers arbitrage market inefficiencies to generate “alpha”, so too do companies eliminate market inefficiencies by delivering value to customers. The way all companies (not only start-ups) generate “alpha” is to just keep a slice of that value created for themselves. This is illustrated by the simplified diagram below, using Uber as an example.

Seeking like-minded people

In conclusion, I want to go where the most inefficient markets are, deliver enormous value to our customers, and capture a slice of that value for myself and my business partners, and I want to do it at scale.

Based on my conversations with other entrepreneurs and investors – I feel that very few people share my philosophical approach and see the same link between entrepreneurship and hedge fund investing as I do. If you are one of the few people in the world who thinks this way – please reach out to me!

Part 2 – Warren Buffett’s influence on how I think about entrepreneurship, and To come: part 3 – Long-term goals and how I hope to get there (with your help!).