A while back, I met an entrepreneur. Let’s call him Gary (not his real name).

I took a liking to Gary, and I took a small amount of funds from my “highly speculative” bucket and put it into his project. The amount was nothing to lose sleep over. From the beginning, I thought of this as an angel investment, and I was fully prepared for it to go to zero

Soon, I could tell that Gary wasn’t making much progress. As the weeks passed, we began to correspond less frequently. And in May, Gary stopped responding to me entirely.

Markets had tanked, and I figured that Gary was embarrassed that his project wasn’t going well. But it felt a bit odd–not even a “Hey man I tried my best and it didn’t work out”.

Nope, he just left my messages unread and cut off contact.

Then I started hearing stories. Close friends and 2nd degree connections had given Gary hundreds of thousands of $.

Some of these were framed as loans with guarantees of return.

Uhoh. 😱

As horror stories started trickling in, I felt lucky that I had lost relatively little. But still, I wanted to reflect and learn from this experience.

First, why did I take a liking to Gary?

The short answer is that I pattern-matched. And here is the longer answer:

I saw a chip on Gary’s shoulder.

I could tell that Gary was intelligent. He didn’t go to a brand-name college. He had a certain type of hunger, an innate drive that I’ve seen in so many successful friends. He was also afflicted by a visible physical condition (not a literal chip on his shoulder but close to it)

Gary exuded authenticity, empathy, and vulnerability.

When we first met, we had a long, deep conversation. I felt like his empathy level was off the charts. In retrospect, I question how much of his emotions were genuine.

Gary was extremely responsive.

I correlate responsiveness with overall competence. Gary was definitely one of the most responsive people I’ve ever interacted with. He seemed to work around the clock, responding to all my messages within 5 minutes.

I was influenced by someone else’s judgment.

A good friend vouched for Gary. I should have been smarter. This friend even warned me long ago that they weren’t the best judge of character.

I was influenced by name-dropping.

Everyone in the start-up world does this. When you pitch, you mention existing investors and marquee partnerships. It becomes a self-fulfilling prophecy. Gary’s fluff didn’t raise any red flags at the time. In retrospect, the bullshit-to-value ratio was a bit much.

Reciprocity is a powerful urge.

When I first met Gary, he dropped nearly $10,000 at a nightclub for me and a large group of friends.

In retrospect, this money surely came from one of his previous investors.

At the time, we were all flabbergasted. We had never seen this behavior before. But hey, you don’t kick a gift horse in the mouth!

I assumed that someone this generous must be successful.

I don’t like owing favors, so I actually Venmo’ed Gary a few bucks the next day.

Despite my chipping in, the feeling of generosity stuck. And I was conditioned to look favorably upon him. I didn’t lose anywhere close to $10,000, but let’s just say that I paid for more than my fair share of that night.😆

And ultimately, I paid tuition for the school of life.

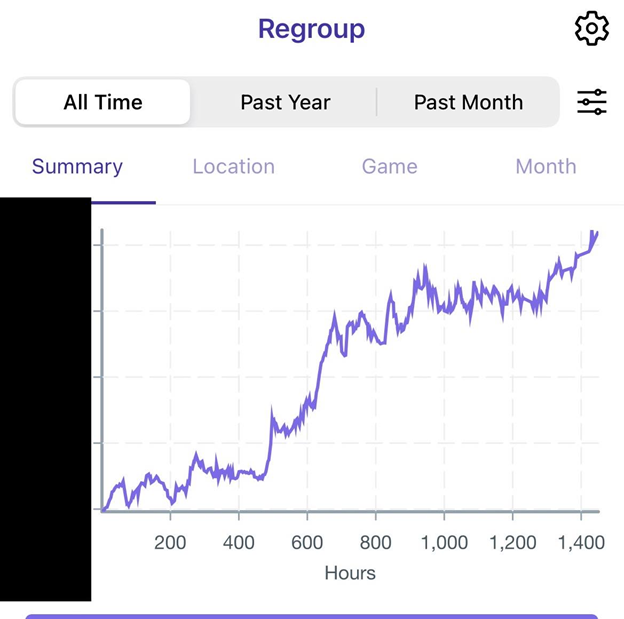

From a major investment mistake 8 years ago, I’ve learned to treat mistakes as a fee, not a fine. Also, I had learned to keep losses small, and I was fortunate to get off light this time.

Concluding thoughts on entrepreneurship

Given my chosen career path, and my personality, I meet a lot of interesting people.

In the circles I hang around in, there are many brilliant people. But there are a few deeply flawed people as well – suave sociopaths, charismatic conmen, you name it.

Surely, the people existed around me earlier in my life too. Was I simply too naive to notice them? Yes, but the stakes were also lower then. I had less to lose, and those people were also younger, and less skilled at their wiles.

Are you an aspiring entrepreneur or early stage investor?

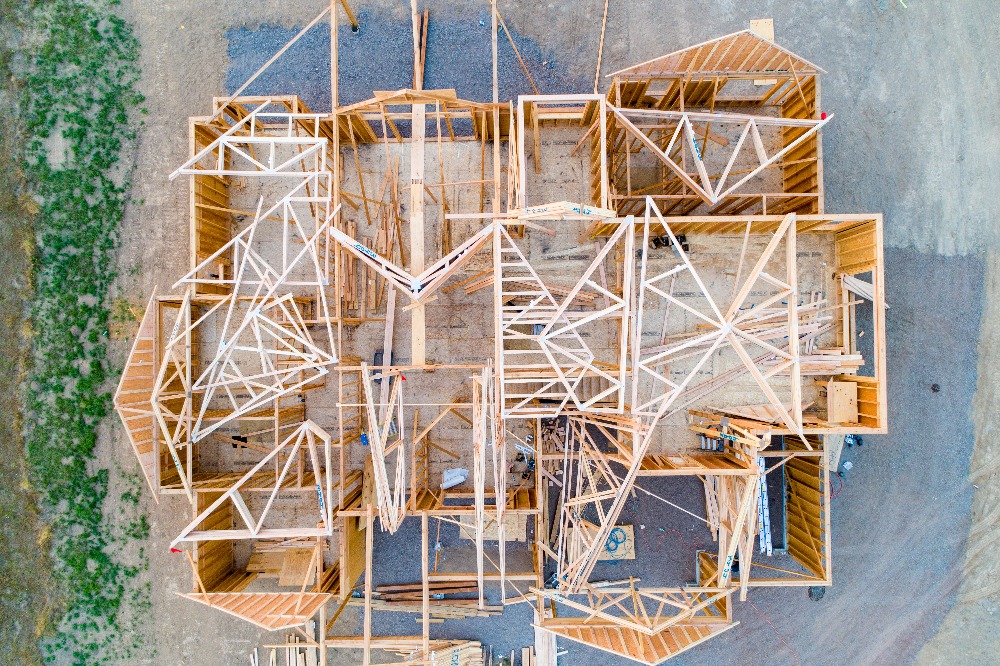

My philosophy is that to get the good, you must expose yourself to the bad. If you choose only the safe path, your opportunities will be limited.

In this entrepreneurial world we live in – mistakes are part of the course.

Entrepreneurship is about taking calculated risks, and learning from them. You must be willing to look foolish.

I’ll continue to make mistakes for the rest of my life.

By pure magnitude, my mistakes will get bigger. (I hope!) But as a % of my net worth, I plan to keep them small. And accordingly, the emotional impact will be minimal.

As long as we keep learning, we will not make the same mistake. And ultimately, our learnings will compound, and we can make more asymmetric bets.